fulton county ga property tax sales

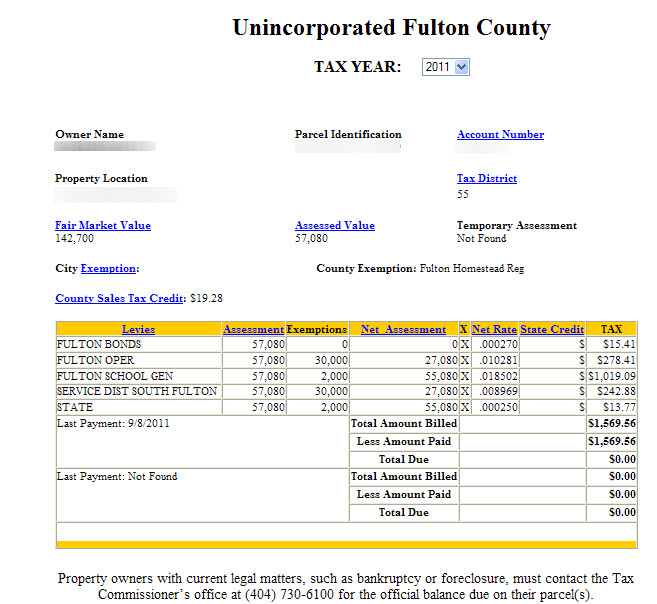

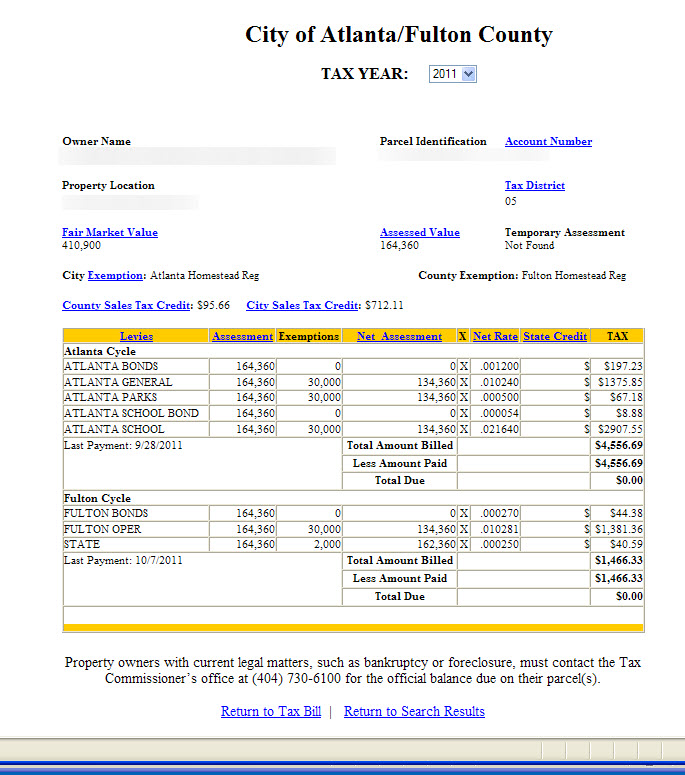

The current total local sales tax rate in Fulton County GA is 7750. The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school.

Georgia Property Tax Liens Breyer Home Buyers

Fulton County Sheriffs Tax Sales are held on the first.

. SUT-2017-01 New Local Taxes 13182 KB. Online filing is available by using our SmartFile system. Expert Results for Free.

By now all Fulton County property owners should have received tax statements by mail. Ad View public property records including property assessment mortgage documents and more. A TAX SALE IS THE SALE OF A TAX LIEN BY A GOVERNMENTAL ENTITY FOR UNPAID PROPERTY TAXES BY THE PROPERTYS OWNER.

Surplus Real Estate for Sale. If the process requires litigation you better solicit for help from one of the best property tax attorneys in Fulton County GA. Surplus Real Estate for Sale Read More tax refund after lien sale Read More property and vehicles.

Atlanta Georgia 30303-3487. Fulton County lewis slaton courthouse Plats and Lands. Fultons rate inside Atlanta is 3.

The 2018 United States Supreme Court decision in South Dakota v. The Fulton County Tax Commissioner is responsible for the collection of Property. The median property tax in Fulton County Georgia is 2733 per year for a home worth the median value of 253100.

The Fulton County sales tax rate is. Click this link to access SmartFile. The December 2020 total local sales tax rate was also 7750.

48-5-311 e 3 B to review the appeal of. The Fulton County Sales Tax is 4. Fulton County collects on average 108 of a propertys assessed.

Find property records tax records assets values and more. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties. The City of South Fulton property taxes also known as ad valorem taxes are billed and collected through Fulton County Tax Commissioners office.

Sales Tax Bulletin - New Atlanta and Fulton County Sales Taxes. Fulton County Tax Commissioner Dr. Just Enter Your Zip for Free Instant Results.

Easily Find Property Tax Records Online. Some cities and local governments in. 6 rows The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state sales.

Ferdinand is elected by the voters of Fulton County. A county-wide sales tax rate of 4 is applicable to localities in Fulton County in addition to the 4 Georgia sales tax. Payments can be made through major credit cards eBilling eChecks Apple Pay and.

Fulton County GA currently has 3696 tax liens available as of September 13. The 2021 property tax bill also includes. Substantiated data assessors have to operate when doing.

The Georgia state sales tax rate is currently. Fulton County Board of Assessors. The total Milton millage rate for 2021 is 5218 mills.

The annual millage rate is 4731 all of which is designated to fund general government operations. Find Information On Any Fulton County Property. The Fulton County Board of Assessors reserves the right when circumstances warrant to take an additional 180 days pursuant to OCGA.

Ad Just Enter your Zip Code for Property Tax Records in your Area. Ad Find Fulton County Online Property Sales Info From 2022.

Press Release Announcing A Proposed Property Tax Increase

Press Release Announcing A Proposed Property Tax Increase

Tax Allocation District Tad Atlanta Ga

Fulton County Georgia Property Tax Calculator Unincorporated Millage Rate Homestead Exemptions

Fulton County Board Of Assessors

Spire Condos Pool Atlanta Condo Condo Spires

Johns Creek Joint News Release From 15 Fulton County Cities On Local Option Sales Tax

Fulton County Reduces Millage Rate For 2022

Happening In Fulton Property Tax Bills Due

Fulton County Cities Oppose 600 Increase Sales Tax Proposal 11alive Com

Frequently Asked Questions Faq About Georgia Property Tax Appeals Hallock Law Llc Property Tax Appeals

Fulton County Board Of Assessors

Fulton County Proposes To Maintain Current Millage Rate

Atlanta Georgia Property Tax Calculator Fulton County Millage Rate Homestead Exemptions

Redeem A Non Judicial Tax Deed Gomez Golomb Law Office

Fulton County Ga Hallock Law Llc Property Tax Appeals

Fulton County Property Owners Will Receive 2022 Notices Of Assessment